IFFM Blog 8. International Mergers and Acquisitions

Gan Kian Siong: ID no: 14045693

Note: This is the last blog of the lecture in class learning, the topic itself coverage are wider on M&A (in general) and the contents is expected to be longer in order to express the linkage.

Brief History of Mergers and Acquisitions

Tracking back to history, Mergers and Acquisitions have evolved the events coincided in five stages were triggered by major economic factors. M&A history adapted from the history of M&A activity around the world (Martynova & Renneboog, 2008).

Wave 1. 1890s~1900s. Economic expansion was driven by the industrialization process, (mostly European and American) introduced new state legislation, the birth of NYSE world’s platform.

Wave 2. early 1900s~1929s. Economic recovery after the market crash and the first world war treaty gave mandates to strengthen enforcement of the anti-monopoly law, particularly in US and Europe.

Wave 3. 1950s~1973. Economic recovery after second world war, until late 1973 oil crisis led into stock market crashed and economic slowdown.

Wave 4. 1981~1989. Economic recovery after recession begins in technological era progress in electronics sector, change in anti-trust policy, deregulation of finance and new financial instrument trading introduced, MNC company set up

Wave 5. 1993-Present. Economic recovery cycle from time to time, China policy to improve FDI and achieved 2nd largest economy and the Dows Jones Index hit a record high in 2016.

M&A 2015 Review

The company pursues M&A that maximizes expected value, even at the expense of lowering near-term earnings while some companies offer a high premium to acquire. Companies typically create most of their value through day-to-day operations, but a major acquisition can create or destroy value faster than any other corporate activity. With record levels of cash and relatively low debt levels, companies increasingly use M&A approach to improving their competitive positions (Rappaport, 2006). According to JP Morgan Global M&A deal report 2015, table 1. Illustrate a total M&A deal value amount reaches USD 5 trillion where the M&A as a % GDP topped 6%.

Table 1. Source: JP Morgan, Jan 8, 2016. Global M&A Activity

Biggest M&A Deals of 2015 review

Based on Business Insider M&A 2015, table 2. Shows the top 10 biggest M&A deal of 2015. Pfizer/Allergan an American global pharmaceutical corporation top the M&A deal of USD160 billion.

Survey from KPMG on M&A 2016 outlook

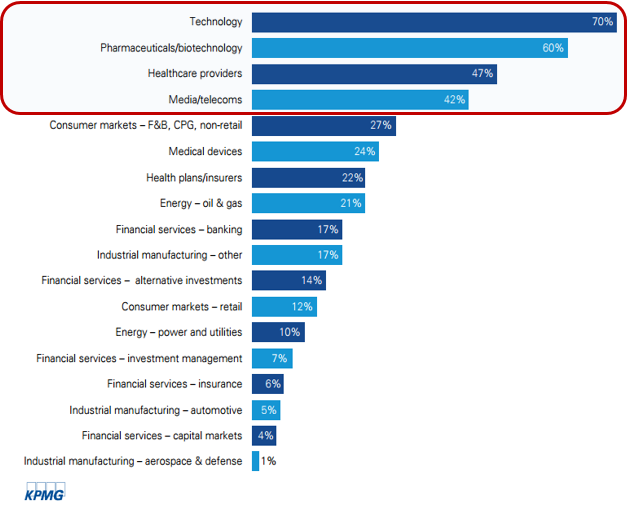

Base on KPMG M&A 2016 survey findings over 550 M&A professional in partnership with Fortune knowledge group, paints a bullish outlook for M&A activities in 2016. The survey results found in table 3. The top majority of respondents (70%) expected that technology would see most deals follow by (60%) in pharmaceuticals/biotechnology. Next will be the healthcare (47%) and telecoms (42%) were expected to be among the most active M&A activities.

Table 3. Source: KPMG. M&A 2016 outlook

Table 3. Source: KPMG. M&A 2016 outlook

From KPMG survey 2016, shown in table 4. Identified some primary reasons for the acquisitions or capital investment intends to initiate in 2016. Most of the top three respondents of both 37% wanted to enter into new lines of business and expand customer base, 36% expand in cross-boarders, 34% enhance intellectual property (IP) rights to acquire new technologies etc.

Brief Introduction to Merger and Acquisition

A merger occurs when two corporations agree to marry on an equal basis. An acquisition occurs when one company purchases another. Conceptually, the two are sufficiently similar that most analysts commonly use the terms interchangeably. The typical method of execution is the tender offer, which simply invites shareholders to present their shares in exchange for cash or stock. Its execution can be contingent on enough shares being tendered (Arnold, 2013). The role of the investment bank is not only to advise but also to facilitate and handle the legal parts of the M&A processes (Welch, 2009).

M&A Basics: Three Types of Mergers

Vertical Merger – A combination between companies with different product stages, usually inter-related to the same industry. Goal is to enhance transaction efficiency

Horizontal Merger – Mainly refer to two companies that are engaged in the same line of activities are combined in same markets. Create economic of scale, scope, and synergies

Conglomeration Merger – Mainly refer to companies are unrelated business activities that have no common business areas. Investment companies aim for capital structure diversified to reduce portfolio risk. Table 5. Demonstrate the breakdown of the three types mergers.

Table 5. Source: Corporate Finance Management, 2013. Fifth edition.

Reasons for Mergers and Acquisitions

CEO are often enthusiastic about acquiring more companies, though it is often not a necessary that the acquisition benefits the acquirer’s shareholders. As far as stakeholder are concerned, running a bigger company usually means more prestige and more compensation down the line. In some cases, however, this enthusiasm is short-lived. If an acquirer underperforms significantly in the years after the acquisition, existing management may face a larger risk of being ousted. If an acquisition is bad enough, it can contribute to such poor performance and thus management dismissals. In contrast, target managers are often reluctant participants, they often lose not just their independence but also their jobs (Welch, 2009).

For example, hostile acquisitions in the United States are subjected to a smaller pool shown in table 6. Firstly, hostile acquisitions are very rare. In a typical year, there is only a handful of them. Secondly, a hostile acquisition that can be quite large. In particular, 1999 saw the hostile takeover of Warner-Lambert by Pfizer for just under $90 billion. With this one exception (highlight in the pink circle), hostile activity was far more common from 1983 to 1989 than in other years (Welch, 2009).

Table 6: Source: Adapted from Ivo Welch, Hostile Takeover Activity in the United State

Brief in Difference Between M&A Takeover and Motives

The general purpose for the M&A takeover when it is commonly seen, as a firm seeking to increase a larger market share (economics of scale), increase speed to new entry market, leverage certain R&D and products capabilities, lower the risk on technology know-how of new develop product line structure, avoid excess competition etc. Below are brief differences encounter.

The Benefits and Value Change of Mergers and Acquisitions

The greatest value creation toward M&A path remains the quickest route, as companies could have the leverage to new markets, access entry to a new territory or experience new capabilities to further enhance core competency. Vast markets globalization, and the pace at which rapid technologies change constantly to accelerate, companies are finding M&A to be a compelling strategy for growth (Welch, 2009). Some important causes of corporate value gains are highlighted as follows:

Scale synergies: The merging of systems, skills, structures, departments, and staff can improve operating efficiency. Efficiency gains due to economies of scale can result from greater sources.

Elimination of duplicate departments and fixed overhead can lower operating costs. For example, legal, human resources, logistic & supply chain, IT division may be combinable.

Reduction of market imperfections: Smaller firms may also find it easier to tap the public financial markets and thus gain financing efficiencies by linking with other firms into one entity that was then large enough to be taken public. It would be able to reduce the idiosyncratic risks.

Production and distribution efficiencies, for example, in the merging of ATM networks, can attract more bank customers. Production lines and shipment route, freights can be consolidated.

Reduction of competition: The elimination of the target from competition with the acquirer can make it easier to raise prices and control the market size and output.

Subject Matter Expertise: An acquirer may find it easier to purchase a firm than to build up the expertise of the target. Although this may not raise the overall value of the new entity, doing this could still be the cheapest option for the acquirer.

Tax benefits: Higher debt ratios reduce the amount of taxes collected by the IRS.

Better governance: The need to service debt usually makes it easier to convince both managers and employees that they have to work harder and spend less on pet projects.

Idiosyncratic risk reduction: Takeovers naturally increase the scale of the firm. This typically reduces the idiosyncratic risk of the firm and increases the firm’s revenues and earnings.

Larger empire: Acquiring CEO is endeavored to run bigger firms not only because it makes them more important but also because CEO of bigger firms usually receive more compensation.

Problems encounter during M&A

M&A transactions can create or destroy value for shareholders or a company. For an instant, according to HBR survey found that in 1988, nearly 60% of the value of large deals—those over $100 million—was paid for entirely in cash, less than 2% was paid for in stock. But just ten years later, the profile is almost reversed: 50% of the value of all large deals in 1998 was paid for entirely in stock, and only 17% was paid for entirely in cash. This shift has profound ramifications for the shareholders of both acquiring and acquired companies (Rappaport et al., 1999).

Cash or Stock deal

The distinction between cash and stock transactions were found as follows;

In a cash deal, acquiring shareholders take on the entire risk that the expected synergy value embedded in the acquisition premium will not materialize. In a cash deal, the roles of the two parties are clear-cut, and the exchange of money for shares completes a simple transfer of ownership.

In a stock deal, that risk is shared with selling shareholders. More precisely, in stock transactions, the synergy risk is shared in proportion to the percentage of the combined company the acquiring and selling shareholders each will own. In an exchange of stock share deal, it becomes far less clear who is the buyer and who is the seller. In some cases, the shareholders of the acquired company can end up owning most of the company that bought their shares. Companies that pay for their acquisitions with stock share both the value and the risks of the transaction with the shareholders of the company they acquire.

Bottom-line M&A decision to use stock share instead of cash can affect shareholder returns as the cash flow from financing activities will be diluted, dividend payout to the shareholder will be more likely to reduce (Rappaport, 2006).

Methods of Resistance (Possible financial defenses methods)

Target management can resist being acquired with some very powerful tactics, when approached by an unwelcome outsider, they can resist a hostile takeover. Among the more prominent defenses, there are many examples, however, (a few common approaches are highlighted as follows).

· Greenmail: Management uses shareholders’ money to “buy off” the shares of a potential acquirer at a premium. This has become rare due to bad publicity.

· Acquisitions: The target management could use a blowfish defense method to buy other companies it is because a bigger company is more difficult to take over.

· Scorched earth: Management can threaten to sell off corporate assets that are of particular interest to the acquirer.

· Poison pill: When triggered, a poison pill entitles other shareholders to purchase more shares at a discount. The potential company would then have to repurchase these shares at the acquisition price, too. This approach could shut down all hostile acquisition activity.

· New share issuance: Management issues more shares to employees and themselves. Similar alternatives are accelerating the vesting of existing shares and options, and promising high severance packages for any employees wanting to leave if the firm is taken over. The acquirer would then have to repurchase more shares and pay employees more.

· Fair value provision: A fair value provision forces an acquirer to pay every shareholder the same price, the highest price at which any share can be acquired that the effective share acquisition price changes from the lower average price to the higher marginal price.

· Supermajority rule: An acquirer is required to consistently obtain more than just a majority of votes to replace the board if necessary.

Top M&A Valid ongoing concerns

Base on the report issued by Deloitte, 2013, shown in table 7 indicated by 37% of the directors and 43% of the CFOs who participated in the survey, on top M&A ongoing concern. Most of the management agree on a number of issues regarding risk oversight and value creation in M&A activities. A range of questions on risk issues related to M&A. according to the survey, top two major concerns are (1) is the economic uncertainty (18%), (2) while CFOs cite the regulatory and legislative environment (16%) rate as their biggest concerns (Deloitte, 2013)

Table 7. Source: Adapted from Deloitte, 2013. The Wall Street Journal news department.

The other greatest risk to integration, a survey conducted by Deloitte in table 8.1, management agrees that the greatest cause for concern during merger integration is achieving a cultural fit, which is the most worried for most companies, less than capturing synergies, transitioning workforces or retaining customers. “Cultural integration remains more unpredictable”, and therefore a riskier. (Deloitte, 2013).

The next greatest concern in valuing a target company survey conducted by Deloitte in table 8.2, overstated revenue forecasts are by far the number one valuation risk when evaluating a company’s worth according to the survey. The target company is expected to differ in predictable ways when valuation is required to review their cash flow optimistically, such as expenses matches the balance sheet accountability for the capital requirements used (Deloitte, 2013).

Table 8.1~2. Source: Adapted from Deloitte, 2013. The Wall Street Journal news department.

Mergers & Acquisitions from the firm’s perspective

An appointed specialize consultant or professional investment banks will be involved in the M&A process. These advisers make good fees from M&A financing and from M&A advisory role. They will be so much eagerly pushing for potential transaction deal. Other investment banks make money by “defending” the target. They will as well earn good fees from the targeted company. Often there are other stakeholders in the firm: they are often squeezed in the initial stages of a completed takeover, but if a target is better managed after the acquisition, it may actually grow more in the long run (Welch, 2009).

In some cases, the long-run beneficial effects can be much higher than the short-run pain. Table 9.1, based on Thomson Reuters M&A review 2015, statistic shows the worldwide completion of M&A deals with a total accumulated fee paid in the full year 2015 was recorded USD 3.16 trillion. Table 9.2, shows top 5 are Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America and Citi Bank.

Table 9.1. Source: Thomson Reuters Global Mergers and Acquisitions 2015 Review

Table 9.2. Source: Thomson Reuters Global Mergers and Acquisitions 2015 Review

Key success and failure of M&A

Case 1. P&G acquisition of Gillette, the combined company benefited because P&G had stronger sales in some emerging markets, Gillette in others. Working together, they introduced their products into new markets much more quickly (Bloomberg, 2016).

Case 2. Top M&A Royal Dutch Shell and BG Group announced back in April 2015, these were the first major deal for an oil and gas producer since the rout in oil prices began. Companies were wary of making deals when prices were in freefall, but now some sector assets simply look too cheap to ignore. With energy prices expected to stay low in 2016, there will be expected more deals of this size of a mega deal (Burrows, 2015).

Case 3. Past collapses in oil prices have prompted a deluge of the deal. For example, according to Channel news Asia, SIA has announced its group net profit for the first quarter 2016 nearly tripled from the previous year due to lower fuel prices and divestment gains. SIA has declared the operating costs were favorable by S$161 million to S$3.4 billion this year, due to a 28% fall in fuel prices. As activity looks set to pick up again in the current period of low price, a confluence of events makes acquiring more attractive. And acquiring company would want to look out to strengthen their competitive positions as new opportunities emerge (Evans, Nyquist, & Yanosek, 2016).

According to Mc-Kinsey & Company report analysis, the M&A performance during a previous period of low prices, from 1986 to 1998. Of all these deals when prices were low, only megadeals, on average, outperformed their market index five years after the announcement. Periods of flat prices appear to call for a focus on cost synergies and scale. In contrast, in the period from 1998 to 2015, which was characterized mostly by a rising-oil-price trend, more than 60 percent of all deal types outperformed their market index five years after the announcement. Not surprisingly, this kind of rising-price environment rewarded deals that were more focused on growth through acquisitions of overlapping or new assets (Evans, Nyquist, & Yanosek, 2016).

References

1. Arnold, G. (2013). Corporate Financial Management . Person.

2. Bloomberg. (2016, July 20). Unilever Takes on Gillette with $1 Billion Dollar Shave Deal.

3. Bohan, O., Josefsen, M., & Steen, P. (2012, July 01). Shareholder Conflicts and dividend policy. Journal of Banking and Finance.

4. Burrows, D. (2015, Dec 29). 10 Biggest Mergers and Acquisitions of 2015. Bloomberg.

5. Deloitte. (2013, October 3). Post-deal Integration: Top M&A Concern for Directors and CFOs. The Wall Street Journal.

6. Evans, B., Nyquist, S., & Yanosek, K. (2016, July). Mergers in the Oil patch: Lessons from past downturns. McKinsey&Company.

7. Finanical Times. (2016, July 20). Morgan Stanley boosted by cost cuts and M&A.

8. Martynova, M., & Renneboog, L. (2008). A Century of Corporate Takeovers: What Have We Learned and Where Do We Stand? Tilburg University.

9. Rappaport, A. (2006, From the September Issue). Ten Ways to Create Shareholder Value. Havard Business Review.

10. Rappaport, A., & Sirower, M. (1999, From the Nov-Dec Issue). Stock or Cash?: The Trade-Offs for Buyers and Sellers in Mergers and Acquisitions. Havard Business Review.

11. Welch, I. (2009). Corporate Finance: An Introduction. Pearson.

No comments:

Post a Comment