Blog 5. Capital Structure Decisions (Gearing) Gan Kian Siong ID No: 14045693

Capital structure is the form of the debt and equity a company use to finance its long-term operations and growth according to the accounting 101 balance sheet basics (Celender, 2013), table 1. The company uses capital structure components, to distinguish it optimal value through the weight average Cost of Capital, to proportionally measures the rate of return based on the NPV of equity and debt when company obtaining new funds that shareholder expect for their investments (Ghosh, 2012).

Table 1. Adapted from Michael Celender. Accounting Basics, 2013.

In table 2, based on the U.S. Securities and Exchange Commission reports, illustrated the corporate capital structure breakdown into 3 categories such as equity, unsecured debt and secured debt clusters with the key characteristics of the diversified portfolio. The debt securities that has a margin of higher asset safety protection coverage with debt market of bank loans, high-yield credit debt or convertible bonds, while it also providing expected returns yield potential with selected shareholder’s equities that are discounted with the key characteristics assets class assessment, crucial portfolio appraisal will be conducted by the corporations (Villalta, 2012).

Table 2. Adapted from the U.S. Securities and Exchange Commission, Sept, 12, 2012

An example shown in table 3 (data extracted from Thomson Reuters), manager’s fees from capital markets transactions during the first quarter of 2016, total sum amount to US$3.46 billion (70%) from top 20 financial institutions and banks related that have 4,158 deals transacted with total debt market of $1.1 trillion in just U.S. securities and exchange alone.

Table 3. Source: Thomson Reuters, Debt Capital Market Review Q1, March 01, 2016

Components of Capital Structure

The corporate capital structure comprises two types of sources categories from shareholder’s funds and borrowed funds which generally requires long-term capital fund raise by the company (Myers, 2005). Table 4, show company consider these varying terms and rights when deciding which source of capital to use.

Table 4. Source: Adapted from Glen Arnold, 2013. Corporate Financial Management

The first group is the shareholder’s fund which funds are provided or invested by the owners as the form of equity capital, preference shareholders, and retained earnings. The second group is the borrowed capital funds raised through the debt markets as the form of debentures capital, Term loans, and public deposits.

Shareholder’s Capital

· Equity capital - owners of the company each invested equity capital into their company to fund business operation and expansion. It represents the ownership capital of the company that is free of debt capital received for an interest in the ownership of a business. They are the real risk bearers, but they also enjoy rewards. Their liability is restricted to their capital contributed.

· Preference shareholders related to the payment of dividends and repayment of Capital. The preference shares carry a stipulated dividend. Preference Shares are of different types such as redeemable and non-redeemable, Convertible and Non-Convertible, Cumulative and Non-Cumulative preference shares.

· Retain Earnings are distribution direct from all the profitable earnings that reported to shareholders by a form of dividend payout, the firm retains / keeps / saves a part of the profit for self-financing. Retained earnings constitute the sum total of those profits which have been realized over the years and have been reinvested in the business.

Borrowed Capital

· Debentures capital is a part of borrowed capital. The creditors of the company are the debenture holders. Different types of debentures are issued for the convenience of investors.

· Term Loan which organizations can obtain long-term and medium-term loans from banks and financial institutions. Term loans are repayable by installments with interest paid. For obtaining term loans, collateral security has to be offered by the organization.

· Public Deposits which money received by a non-banking company by way of deposit or loan from the public, including employees, customers' and shareholders of the company other than in the form of shares and debentures. Companies prefer this method as such deposits are unsecured. A company can accept public deposits for a period of up to 3 years.

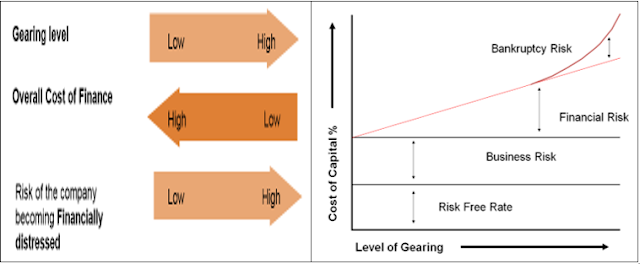

The effects on the capital structure using greater amounts of debt

Although the advantage of increased debt is the increased benefit from the interest expense as it reduces taxable. An increased debt load has the effect on the capital structure foundations (Ghosh, 2012). For an instant, an expense rises in the interest, the cost of debt interest payment will be adding pressure to the cost of capital, therefore the cash flow needs to cover the interest expense will increase as well.

Lenders and shareholder become concerns that the company will not be able to cover its financial liability. If interest increases, debt / equity will increase and EPS decreases, and a lower stock price is valued. Additionally, if a company, in the worst case, may default payment and goes bankrupt, and company debts were reckoned and the shareholders are the last to be paid retribution (Arnold, 2013).

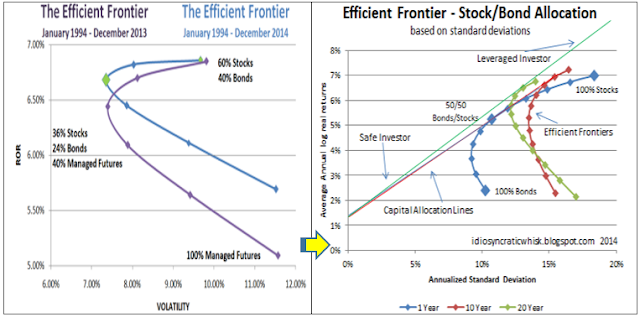

Nevertheless, an optimal capital structure is some combination weight on both equity and debt that recognizes the company earnings yield and stock price. This is best implied by the capital structure that minimizes the company's WACC. Company’s stock valuation will usually be rated higher when there is minimum WACC employed vice versa. As such, an optimal capital structure suggested 40% debt and 60% equity. While there is a tax benefit from debt, the risk to the equity can far outweigh benefits - table 5.

|

Table 5. Source: Bloomberg and The Wall Street Journal 2015.

Company vs. Stock Valuation

The value of a company's stock is but one part of the company's total value. The value of a company comprises the total value of the company's capital structure, including debt holders, preferred equity holders and common equity holders (Arnold, 2013 & Institute of Management Accountants, 1997), illustration in table 6. Since both debt holders and preferred equity holders have first rights to a company's value, common equity holders have last rights to a company value, also known as a "residual value" (Villalta, 2012).

Table 6. Source: Adapted from Glen Arnold 2013. Corporate Financial Managment

Optimal Capital Structure

An optimal capital structure shows the best balance of debt to equity, a company can minimize its cost of capital and hence to maximize its market value. In essence, an optimal capital structure attempts to optimize a firm’s cost of capital and the market value of its securities (Villalta, 2012). There should be a judicious mix of short and long-term debt to help create a lower overall cost of capital. The cost of debt is lower than the cost of equity because interest on the debt is tax-deductible (Myers, 2005). The cost of equity consists of the dividends a company pays to shareholders. Equity is dividend a company pays to shareholders. Debt is because interest on the debt is tax-deductible. Where debt-holders’ claims to funds take priority over shareholders. Debt may be cheaper, but it also carries the risk of not being able to make payments on time, which can lead to bankruptcy (Arnold, 2013).

The company, however, could conduct due diligence finding an optimal capital structure that minimizes the cost of financing and minimizes the risk of bankruptcy. For an instant, if a company finances 40% of its efforts with debt at 5%, and the other 60% comes from equity at 10%, its average weighted cost of capital will be 8%. While this suggests that a firm would incur a cost of capital of 5% if it used debt for all of its funding, that would not be its optimal capital structure because of the high bankruptcy risk it would carry. That risk grows as a company’s debt increases (Ghosh, 2012).

Table 7 (data extracted from FCA and GM annual report 2015 and presented in excel format), illustrates two companies’ financial ratios with same automobile industries (FCA vs. GM). A higher ratio shows a company uses debt to finance much of its growth. If earnings do not exceed the cost of debt, the probability of financial distress of the company might be creeping around the corner. Debt-to-equity ratios can serve as red flags for certain investments and could trigger the share price volatility. However, investors should not only use single ratio to compare similar companies to make the assumption for financial judgment on investment (Ghosh, 2012). However, the investor used various shareholder valuation ratio as an optimal capital structure (Institute of Management Accountants, 1997). An example applies to the gearing or (leverage ratio) such as total liability / total debt ratio, Debt to Equity Ratio, current asset ratio, capital gearing ratio. On the other hand, the investor usually looks at the shareholder wealth creation via valuation ratio for required return on capital investment such as PE ratio, EPS, Price/ Book value ratio, Price / Cash Flow ratio, Dividend yield etc.

Table 7. Source: FCA and GM Annual report 2015. Debt to Equity Ratio: FCA vs. GM

References

References

1. Arnold, G. (2013). Corporate Financial Management . Person.

2. Celender, M. (2013). Accounting Basics.

3. Ghosh, A. (2012). Capital Structure and Firm Performance. Transaction Publishers.

4. Institute of Management Accountants. (1997). Measuring and Managing Shareholder Value Creation.

5. King, J. (2001, October 31). Accounting 101: Balance Sheet Basics. Canada-one.

6. Myers, S. (2005). Capital Structure. JSTOR.

7. Villalta, T. (2012). THE LARGE - CAP PORTFOLIO. Bloomberg.

useful info

ReplyDeleteAlso I would like to draw your attention to

ReplyDeleteideals data room . It is a very close topic to what you write about in your blog. As any business deal can be made with the help of this tool.