IFFM Blog 3. Capital Asset Pricing Model (CAPM) and Portfolio Theory

Gan Kian Siong ID No: 14045693 Date: July 27, 2016

Introduction of CAPM

CAPM is an idealized portrayal concept for the corporate financial management to measure the cost of equity and to rhetoric, shareholder expected to maximize returns (Frederikslust, Ang, & Sudarsanam, 2008). The process of using CAPM is to determine a required rate of return, on justifying an asset to a well-diversified portfolio, considering that assets are the non-diversifiable risk. Whereby its application could determine the expected returns on capital investments.

Based on the Nobel prize winner William Sharpe and other theoreticians, named as one of the most reputable financial theory has reigned the rigor academic influence since the first has introduced in the 60s. It is commonly by financial managers or financial institution to use CAPM model or Gordon growth model as a supplementary tool to estimate the financial market price securities, in an attempt to develop realistic and useful cost of equity calculations. The model provides a methodology of translating the velocity risk would be critically evaluated. but no longer enough to rely on standard deviation (Arnold, 2013).

CAPM limitations

While CAPM is accepted academically, there is empirical evidence suggesting that the model is not as profound as it may have first appeared to be. CAPM principle although often as the result is subjective and its application continues in stern vigorous debates in the rigor academic disparity against the real financial market practices (Levy, 2012). Despite limitations, the theoretical representation of the CAPM could be useful as an analytical toolkit but not necessarily applicable for a financial manager to use as a vital decision tool. Perhaps below are some assumptions can be commendable as follow.

Firstly, a financial market populated by the advance high speed sophisticated technological system, with information available, investors are well-educated, well-trained to perceive the financial market risk and able to transform it into expected return. Secondly, assumption distinguishes modern investors who care about wealth and profits more to less (profit taking) to reposition it portfolio and look out an opportunity for its portfolio diversification. Thirdly, the hypothetical investors of modern financial theory demand a premium in the form of higher expected returns for the risk of volatility assets with acceptable tolerance. Table 1 illustrates the efficient frontier concept.

Table 1. Source: Adapted from Levy Haim, 2012. The CAPM model in the 21st Century

Measuring Beta in different period

β – Beta – Beta is a measure of stock’s daily volatility and compares company’s share price reacts the overall market as a whole in price movement (Arnold, 2013). For an instant, company share price is sensitive when market reacted to the news with overbought, oversold before it shares price stabilize. Table 2 with three examples, show the deviation involved in obtaining a historical beta are direct and straightforward. However, every individual investor has different preference to decide the period that which frequency is more appropriate to use "daily", "monthly (table 2.1)", "yearly (table 2.2)", or "5 years (table 2.3)" data sources as the base set up for their investment approach. Regardless the period is adopted; each information provides a different estimate of beta deviations.

Table 2.2 Source: Bloomberg.com. Estimate of Beta - "Yearly" Chart Data.

Table 2. Source: Bloomberg.com. Estimate of Beta - "5 years" Chart Data.

Perfect Capital Market

CAPM theory is based on Perfect Capital Market that may not be applicable for such cluster of investors with high-risk takers behavior (Levy, 2012). For example, the true assumption of the model lies not just in the reasonableness of its underlying market perfection theory but also in the validity and application of the model’s prescription. Tolerance of CAPM’s model allows the derivation of a concrete, though the idealized manner in which financial market measure risk velocity and transfer it into expected return (Elbannan, 2014). Lastly, financial theory defines risk as the possibility that actual return will deviate from expected return, and the degree of potential market volatility fluctuation determines the degree of risk. Table 3.

Table 3. Source: Adapted from Haim Levy, 2012. The CAPM in the 21st Century.

The model is an extension of the earlier work of Harry Markowitz on diversification, along with Merton Miller for their further contributions to CAPM-based theory (Elbannan, 2014). The assumption of capital market apply to the basic theory are perceptibly unrealistic in which the international financial market measure risk and transform it into required rate of return (Mullins, Jr., 1982).

The assumption in the perfect capital market theory were made known as are; all investors are risk averse by nature, investors have same period to evaluate market information beyond fundamental or technical analysis, there is unlimited capital to borrow at the risk-free rate of return, investment can be divided into unlimited sizes, there is no taxes or no tax exemption require, inflation or transaction costs (Elbannan, 2014). Nonetheless, due to these prescriptions, investors choose mean-variant efficient portfolios. All these assumptions were radically not aligned with the modern financial market practices. In which, by rectification investors seek to minimize risk and maximize return for any given level of measure risk tolerance and acceptance (Levy, 2012).

Difference between Capital Market line (CML) and Security Market Line (SML)

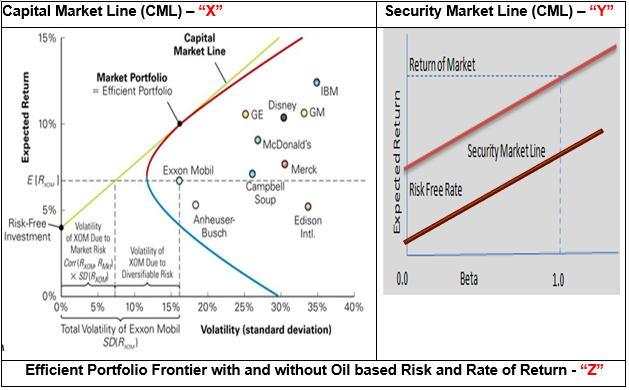

The CML is a line that measures the level of risk through standard deviation, or through a total risk - free rates of return a specific portfolio. The line graphs define efficient portfolios. While the SML measures the risk through beta, and the Line graphs define both efficient and non-efficient portfolios, which representation of the market’s risk and return at a given time (Arnold, 2013).

CML relationship between risk and return for a fully diversified investor, the investor would understand the CML and SML to manage those portfolio while spread the risk in the share investment (Arnold, 2013). The alternative risk and return which parallels in line lie on the straight line. A positive linear effects associated with an example illustrate in table 5, these can be found in all types of portfolio clusters includes without oil (table 5 “X”) and with Oil portfolio (table 5 ”Z”), without oil portfolio includes bonds, property, retail, technology and S&P 500 stocks etc.

CML relationship between risk and return for a fully diversified investor, the investor would understand the CML and SML to manage those portfolio while spread the risk in the share investment (Arnold, 2013). The alternative risk and return which parallels in line lie on the straight line. A positive linear effects associated with an example illustrate in table 5, these can be found in all types of portfolio clusters includes without oil (table 5 “X”) and with Oil portfolio (table 5 ”Z”), without oil portfolio includes bonds, property, retail, technology and S&P 500 stocks etc.

In CAPM discipline, the relationship between risk as measured by beta and expected return is shown on the left side illustrate in Table 5 (“Y”). Based on the CAPM theory all security lie on the security market line, the SML position being determined by the Beta (Arnold, 2013). These are the shares that are not in equilibrium, the higher level of return for the risk, the investor has to absorb the market consequence. If a higher rate of return portfolio is required, the investor is to take the full risk.

Table 5. Source: Adapted from (Levy, 2012, Elbannan, 2014) The CML and SML

The Efficient Market Frontier (EMF)

The EMF is a modern portfolio theory tool that shows investors the best possible return, the set of optimal portfolios that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return with the stock daily volatility investor willing to absorb (Frederikslust, Ang, & Sudarsanam, 2008).

Table 6-A example illustrates the portfolios that cluster to the right of the efficient frontier are also sub-optimal because these have a higher level of risk for the defined rate of return, the outlook of the efficient frontier is curved, rather than linear. (highlighted cycle in red = Risk portfolios)

Table 6-B further explained that if an older investor who are risk averse, they prefer less riskless return portfolio want to allocate the majority of their portfolio to bonds or mutual funds and allocate a smaller portion of the capital to other asset classes. On the other hand, for a younger investor with higher risk tolerance, they are more willing to take high-risk return want to allocate the majority of their portfolio to stock with max various sector and industries.

Table 6-C show a concept between high and low risk and return portfolio combination and diversification of stock and bond allocations that dependent on investor preference.

Table 6 – C Portfolio Combinations – Diversification of capital allocation between stock and bond or mutual funds

Type of Risk – Systematic / Unsystematic

Systematic risk - involves overall market risks, these are the type of risk factors cannot be diversified at the broader way which associate with political or government policy changes, has a direct adjustment on interest rates, exchange rates, and technical recession are an example in shown in table 7. (MSCI Index Research, 2013).

Unsystematic risk – these are classified specific risk involves in an industry and company stock announcements, the massive investors can diversify away of their stock invested portfolio when a vast deviation of the share price volatility causes stock price corrections due to panic selling (MSCI Index Research, 2013).

Table 7. Source: Adapted from MSCI Index Research, 2013.

Nevertheless, these risk factors are the crucial element in part of CAPM model, investor could estimate the rate of return of the stock valuation, it can work out the various possibility of the discount rates to be used for stock appraisal and make a decisive judgement on the performance of an investment strategy in the capital markets. Examples using Citigroup Inc. (Table 8-A) and SIA Limited (Table 8-B), shows that the stock over a year period with correlation risk types involves systematic (with portfolio diversification) and unsystematic portfolio (un-diversifiable) risk. There is similar real case appear in the different industries or sectors. E.g. Bank of America, JP Morgan, SIA, etc.

Table 8-A. Source: Nasdaq.com Citigroup

Inc. Stock Chart July 26, 2016

Table 8-B. Source: Yahoo Finance, Singapore

Airline Ltd. Stock Chart July 26, 2016

References

1) Arnold,

G. (2013). Corporate Financial Management . Person.

2) Elbannan, M. (2014,

December 25). The Capital Asset Pricing Model: An Overview of the Theory. International

Journal of Economic and Finance, 7. doi:10.5539/ijef.v7n1p216

Frederikslust, R., Ang, J., & Sudarsanam, P. (2008). Corporate

Governance and Corporate Finance. Routledge.

3) Levy, H. (2012). The

Capital Asset Pricing Model in the 21th Century. Cambridge University

Press.

4) MSCI Index Research.

(2013). Foundations of Factor Investing .

5) Mullins, Jr., D.

(1982, From the January Issue). Does the Capital Asset Pricing Model Work? Harvard

Business Review.

No comments:

Post a Comment